Each month, the Cromford® Report, a regional real estate data and analytics source, releases real estate insights for the Phoenix Metro area.

Here is key data we have compiled from the June 2022 Cromford® Report for our homebuyers and homesellers:

Phoenix Metro Homebuyers

Housing Supply

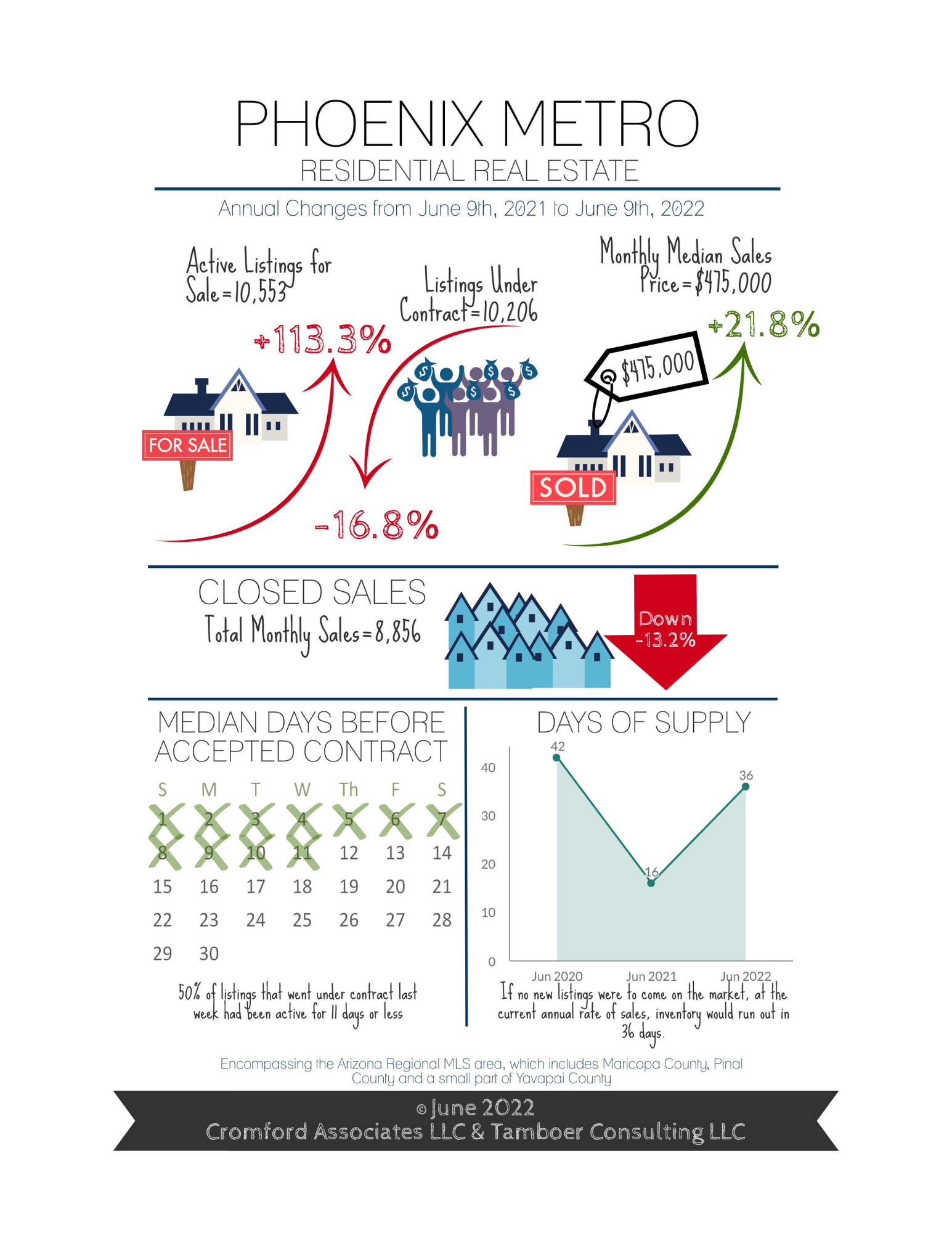

- At the time this month’s Cromford Report was released, on June 9, 2022, the active listing count is 10,553 for the Phoenix Metro area.

- New listings to the market over the price point of $400K are beginning to climb.

- The total supply level is 113% over this time last year.

- Inventory is now at 36. This means that if no homes were listed on the market as of today, we would run out of homes to sell in 36 days.

- For buyers in the market over the price point of $400K (those not put off by rising interest rates), they'll find the housing market becoming a little more comfortable.

- For buyers in the $400K price range and lower, new listings to the market in your price range are beginning to decline because the demand is declining, making the amount of homes available to rise.

- The reason for the supply in the $400K and lower price range's increase is because rising interest rates are keeping buyer demand in that market low, not because there are new listings being added to the market in that range.

- The median number of days prior to contract is now at 11, up from 4 days last month.

Listing Prices

- The monthly median sales price in the Phoenix Metro is $475K

- This is a median price increase of 21.8% from last June.

Breaking Down the Data

- The increase in days-to-contract allows buyers more breathing room for scheduled showings.

- As reported last month (May 2022), inventory increase should not be attributed to the amount of homes being listed.

- Rising mortgage rates are continuing to keep buyers in the $400K price range and lower from swimming in the buyer pool.

- Interest rates are currently at 5.2% (at the time of this release).

- However, the Mortgage Bankers Association predicts that rates will decline to 4.4% by 2024.

Final Thoughts for Homebuyers

Since sellers are now dealing with an increase in the amount of homes for sale, they are now competing for buyers.

As a buyer, you will begin to feel some "normalcy" in the market. This means that inspection contingencies and appraisals will remain what they typically are-- you won't find that they are being waived like they were before.

You will also find the "normal" market conditions with the increase in time-to-contract days, as you won't have to compete as harshly for that home as you would have had to in the recent past.

Buyers should consider the data when it comes to buying now or waiting for a better interest rate.

Buy now (at 5.2% interest):

- For a loan of $425K with an interest rate of 5.2%, your total mortgage (including principal and interest) would be around $2335/month.

- If you refinanced when rates drop (as predicted) to 4.4%, your mortgage payment would lower to $2068/month, saving $267 each month.

Buy in two years (at a predicted 4.4% interest):

- If you waited two years for a lower rate (as predicted by the Mortgage Bankers Association, in the data breakdown above), assuming home prices stayed the same, your mortgage payment for a $425K home would be $2128.

- This is only a savings of $207 to wait for two years.

- If you don't have to buy now, the best way to mitigate your risk is stay where you are and refinance when rates drop below what you are currently locked into, thereby building equity in your current home.

Phoenix Metro Homesellers

Sellers’ Market Status

- Because competing supply continues on the upward trend, you'll notice certain sales measures reflect this.

- One of these measures is the percentage of closing over list price

- Another sales measure changing is the median dollar amount over asking price.

- To date, June has shown 51% of homes closing over asking price with the median being $15K over.

- In the past, weak housing markets are known to also have properties sell over asking price. The difference, though, is that the average of homes closing over asking is only about 15% with the median being $3K over.

- 50% of the listings that went under contract last week had been active for 11 days or less.

Listing Prices / Listing Price Drops

- Total monthly sales are 8,856-- down 13.2% from last June.

- Price drops are now up 258% in the last 10 weeks' time.

- However, in the last month, time on the market prior to contract has also started to increase.

Breaking Down the Data

Due to the rise in supply -- regardless of what the listed price range is-- you'll notice that homes aren't selling over asking price the way they were before.

Buyer contingencies, price negotiations and paying for home warranties will begin to return to the housing market. Eventually, you'll notice closing cost assistance will return as well.

Final Thoughts for Homesellers

The market isn't "normal" yet, but it is moving that way.

Buyers have more options to choose from with less stress of having to be the cash buyer far over the asking price.

It's still a sellers' market, though it may feel like a buyers' market to the folks who now have more homes to choose from and less competition to be the winning bidder.

Source: Tina Tamboer, The Cromford Report, June 2022

June 2022 Phoenix Metro Housing Market Infographic

About the Cromford Report

The Cromford® Report provides detailed information to track the history and current status of the Greater Phoenix residential resale market and offers unique insight into its future direction.

Updated daily and usually published online within a few hours, the Cromford Report is for anyone interested in the state of the market and how it affects their investments and livelihood. Our goal is to present data that is timely, informative and easy to understand - data not available anywhere else in this level of detail or immediacy.

The data used to create the Cromford® Report is obtained from public records and obtained under license from the Arizona Regional Multiple Listing Service, Inc (ARMLS). Cromford Associates LLC and ARMLS expressly disclaim and make no representations or warranties of any kind, whether express, implied or statutory, as to the accuracy of the data used or the merchantability or fitness for any particular purpose.

Source: CromfordReport.com